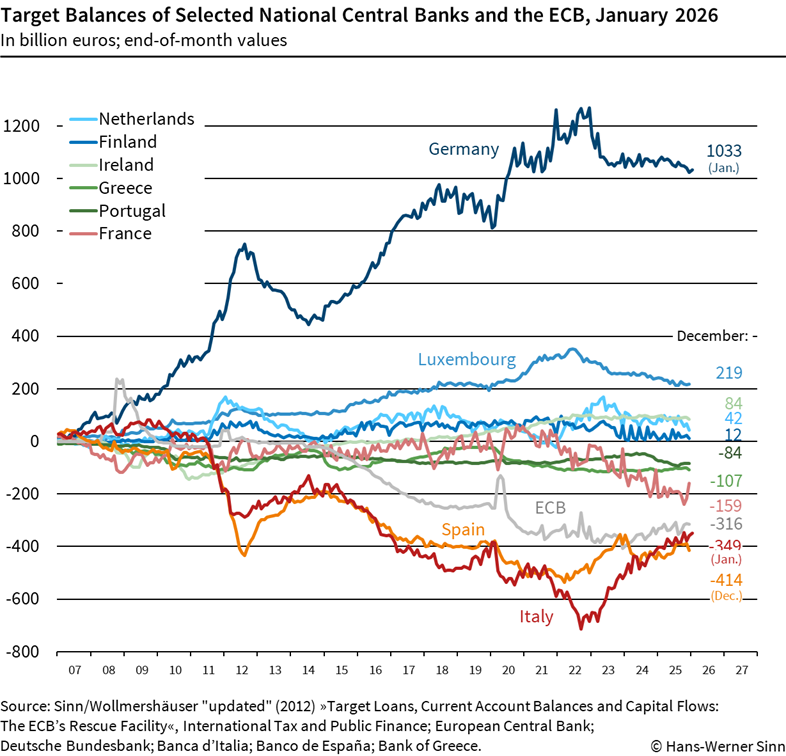

TARGET balances are claims and liabilities between the national central banks of the euro area that accumulate over time through unbalanced euro payment orders between countries. These payment flows reflect transactions for the purchase of goods, physical capital, and financial assets, as well as international fiscal transfers.

Annual changes in TARGET balances measure the so-called balance-of-payments positions of the respective countries (balance-of-payments surplus = current account surplus − private and fiscal capital exports). If a euro-area country’s balance of payments is negative, its central bank’s TARGET balance declines; if it is positive, the TARGET balance increases.

TARGET balances arise from overdraft credits among the central banks of the Eurosystem. These credits are unlimited in amount and have no maturity. They are jointly secured by the Eurosystem as a whole, since the initially bilateral claims and liabilities are transformed into corresponding positions vis-à-vis the Eurosystem itself.

The deeper reason for the emergence of TARGET balances lies in various measures adopted by the ECB to smooth international interest-rate differentials that result from markets’ differing assessments of sovereign risk. TARGET balances would not exist as a persistent phenomenon if the ECB did not intervene and instead allowed markets to determine risk-equivalent interest spreads between national banking systems. In that case, private agents would exploit such spreads by transferring capital to high-interest countries via appropriate payment orders.

TARGET balances thus measure private credit relationships involving national central banks and, indirectly, also credit relationships between euro-area states, because a national central bank initiating a payment does not need to hold previously acquired balances at a common clearing institution, unlike what would be required for payment orders between commercial banks within a single country.

TARGET balances are part of euro-area countries’ net international investment positions, as reported by official statistical authorities. For Germany in 2025, they account for more than one quarter of its large net foreign investment position of approximately €3.5 trillion. A country’s net international investment position is essentially the cumulative sum of its past current-account balances.

TARGET balances are effectively interest-bearing. The interest rate applied corresponds to an average of the Eurosystem’s policy rates, with interest arising from the ECB’s interest-pooling system. This system is designed to prevent changes in the distribution of interest income among national central banks that would otherwise result from payment flows and associated liquidity shifts, as reflected in TARGET balances.

See Hans-Werner Sinn, The Economics of TARGET Balances, Palgrave Macmillan, 2020.

See also: “What do the TARGET balances mean?”, ifo Institute, 15 January 2019.

On the history of TARGET reporting and its interpretation

For a long time, the issue was politically downplayed. However, in 2012 the President of the Deutsche Bundesbank, Jens Weidmann, expressed concerns about the Bundesbank’s TARGET claims in a letter to the President of the ECB, Mario Draghi. Possibly as a result, since September 2015 the ECB has provided an official database containing TARGET data for all euro-area countries. Prior to that, such data had been compiled from national central-bank balance sheets only by the ifo Institute and other institutions (for example, the Institute for Empirical Economic Research at the University of Osnabrück).

The public was first informed about the development and significance of TARGET balances during the crisis by Hans-Werner Sinn in 2011. The formal proof that TARGET balances correspond to classical balance-of-payments positions—in the sense of the difference between the current account and the capital account—was published in June 2011 in a CESifo Working Paper by Hans-Werner Sinn and Timo Wollmershäuser, and subsequently appeared in 2012 in the journal International Tax and Public Finance.

Thereafter, an extensive literature on the subject emerged. Hans-Werner Sinn has continuously updated the analysis in subsequent publications, beginning with Die TARGET-Falle (Hanser, 2012). A comprehensive treatment is provided in The Euro Trap: On Bursting Bubbles, Budgets, and Beliefs (Oxford University Press, 2014), later published in German as Der Euro: Vom Friedensprojekt zum Zankapfel (Hanser, 2015).

The most recent specialized monograph is The Economics of TARGET Balances (Palgrave Macmillan, 2020), which demonstrates in particular that TARGET liabilities imply bankruptcy risks for other countries within the Eurosystem, even if the Eurosystem itself remains intact. The book also formally derives the calculation of interest under the ECB’s interest-pooling system.

In Der Schwarze Juni (Herder, 2016) and in his autobiography Auf der Suche nach der Wahrheit (Herder, 2018), Sinn explains the renewed surge in Bundesbank TARGET claims triggered by the ECB’s large-scale asset-purchase programmes starting in 2015. He shows that these programmes amounted to a massive debt-restructuring operation, in which substantial portions of Southern European public debt were effectively replaced by TARGET credit.

While early reactions included controversial claims portraying TARGET balances as irrelevant accounting artefacts, the interpretation advanced by Sinn and Wollmershäuser has since become dominant among experts. See, for example:

Perotti, R. (2023), “Understanding the German Criticism of TARGET”, Economic Policy, October, pp. 827–861.

Cochrane, J. H., Garicano, L., and Masuch, K. (2025), Challenge, Evolution, and Future of the Euro, Princeton University Press, Princeton, NJ, p. 89.

These authors—including senior ECB economist Klaus Masuch—summarize the issue as follows:

“TARGET2 loans are not merely an accounting phenomenon. They are real cross-border loans provided by one national central bank via the ECB to another national central bank. They finance cross-border purchases of goods or assets.”

Note: The superscript “2” in TARGET2 refers to an older terminology that has since been abandoned by the ECB.

Target Debate (Selected Publications by Others)

Roberto Perotti, "Understanding the German Criticism of Target", Economic Policy 38 (116), January 2024.

David Blake, "Target2: The Silent Bailout System That Keeps the Euro Afloat", Journal of Risk and Financial Management, December 2023.

Presentations

“Target Loans, Current Account Balances and the ECB’s Rescue Facility”, ifo Lunchtime Seminar, June 20th, 2011 | English | ifo mediathek

“Target Loans, Current Account Balances and the ECB’s Rescue Facility”, ifo Lunchtime Seminar, June 20th, 2011 | English | ifo mediathek

Refereed scientific monographs

The Economics of Target Balances: From Lehman to Corona, Palgrave Macmillan, London, November 2020, 159 pages.

The Economics of Target Balances: From Lehman to Corona, Palgrave Macmillan, London, November 2020, 159 pages.

The Euro Trap. On Bursting Bubbles, Budgets and Beliefs, Oxford University Press: Oxford, 2014, 416 pages. Korean edition, Hantee Media Publishing, Seoul, Korea, 2015. To Amazon.

The Euro Trap. On Bursting Bubbles, Budgets and Beliefs, Oxford University Press: Oxford, 2014, 416 pages. Korean edition, Hantee Media Publishing, Seoul, Korea, 2015. To Amazon.

Articles in refereed journals

"The ECB's Fiscal Policy", International Tax and Public Finance 25(6), June 2018, pp. 1404-1433; NBER Working Paper No. 24613, May 2018; CESifo Working Paper No. 7019, April 2018.

"Target loans, current account balances and capital flows: the ECB’s rescue facility" (together with Timo Wollmershäuser), International Tax and Public Finance 19 (4), 2012, pp. 468-508 (Download, 2 MB); (updated version of CESifo Working Paper No. 3500, June 2011 (Download, 1,26 MB) and NBER Working Paper 17626, November 2011); (Download, 931 KB)).

Policy Contributions in Journals and Academic Volumes

“Target Risks without Euro Exits”, CESifo Forum 19 (4), December 2018, pp. 36-48.

"European Imbalances" (with Akos Valentinyi), VOX, www.voxeu.org, March 9th, 2013.

"Mutualisation and Constitutionalisation" (with Harold James), VOX, www.voxeu.org, February 26th, 2013.

"Target Losses in Case of a Euro Breakup", CESifo Forum 13 (4), 2012, pp. 51-58; (Download, 214 KB).

"How Target-Like Balances are Settled in the USA“, in: German American Chamber of Commerce, Inc., ed., United States-German Economic Yearbook 2012 - Annual Survey: German American Business Outlook, 2012, pp. 44-48 (Download, 10 MB).

"TARGET losses in case of a euro breakup", VOX, www.voxeu.org, October 22nd, 2012.

"Fed versus ECB: How Target debts can be repaid", VOX, www.voxeu.org, March 10th, 2012.

"The European Balance of Payments Crisis: An Introduction", CESifo Forum 13 (Special Issue January 2012), 2012, pp. 3-10; (Download, 368 KB).

"The threat to use the printing press", VOX, www.voxeu.org, November 18th, 2011.

"How to Rescue the Euro: Ten Commandments", CESifo Forum 12 (4), 2011, pp. 52-56; (Download, 355 KB).

"Europe at a Crossroads: The Role of the State in a Globalised Economy - Introduction", CESifo Forum 12, 2011, No. 3, pp. 9-17 (Download, 1.2 MB).

"Germany’s Capital Exports under the Euro", VOX, www.voxeu.org, August 2nd, 2011.

"Trade Imbalances – Causes, Consequences and Policy Measures: Ifo’s Statement for the Camdessus Commission", (with Teresa Buchen and Timo Wollmershäuser), CESifo Forum 12 (1), 2011, pp. 47-58; (Download, 151 MB).

"A Euro Rescue Plan", (with Wolfgang Franz, Clemens Fuest, Martin Hellwig), CESifo Forum 11 (2), 2010, pp. 101-104; (Download, 616 KB).

Short Policy Contributions and Newspaper Articles

"Banking Regulation Does not Make Target Credits Safe", SAFE Policy Blog, February 27th, 2019.

"The ECB's actions will not have a good ending", The International Economy Spring 2012, XXVI, No. 2, p. 21.

"European End Game", The International Economy, Winter 2012, XXVI, No. 1, p. 10.

"How to Rescue the Euro: Ten Commandments", VOX, www.voxeu.org, October 3rd, 2011.

"Italy’s Capital Flight", (ref. Project Syndicate October 2011), Les Echos (Mali), Caijing Magazine (China), China Daily Online (China), The Korea Herald (Korea, South), Taipei Times (Taiwan), Poslovni Dnevnik (Croatia), Wyborcza.Biz (Poland), Finance (Slovenia), The Guatemala Times (Guatemala), Jordan Times (Jordan), Al Shabiba (Oman), Al Raya (Qatar), Alrroya Aleqtissadiya (United Arab Emirates), Pontransat.Com (Canada), Het Financieele Dagblad (Netherlands), Expansion (Spain), L'agefi (Switzerland), European Ceo (United Kingdom).

"On and off target", VOX, www.voxeu.org, June 14th, 2011.

"The ECB’s stealth bailout", VOX, www.voxeu.org, June 1st, 2011.

"Farewell to the Euro?", (ref. Project Syndicate June 2011), The New Dawn (Liberia), Les Echos (Mali), Business Day (Nigeria), Caijing Magazine (China), The Korea Herald (Korea, South), Business World (Philippines), Lianhe Zaobao (Singapore), PoslovniDnevnik (Croatia), Aripaev (Estonia), Wyborcza.biz (Poland), Finance (Slovenia), ElCronista (Argentina), O Estado de Sao Paulo (Brazil), Mercados & Tendencias (Costa Rica), The Guatemala Times (Guatemala), JordanTimes (Jordan), Al Jarida (Kuwait), Al Shabiba (Oman), Al Eqtisadiah (Saudi Arabia), Business Insider (USA), L'Echo (Belgium), Il Sole - 24 Ore (Italy), Finanz und Wirtschaft (Switzerland), L'Agefi (Switzerland), European CEO (United Kingdom).

"The ECB’s Secret Bailout Strategy", (ref. Project Syndicate April 2011), Les Echos (Mali), Caijing Magazine (China), China Daily (China), The Japan Times (Japan), The Korea Herald (Korea South), Wyborcza.Biz (Poland), Wyborcza.Pl (Poland), Finance (Slovenia), The Guatemala Times (Guatemala), Al Jarida (Kuwait), Al Eqtisadiah (Saudi Arabia), The International Economy (United States), Die Presse (Austria), DeTijd (Belgium), L'echo (Belgium), Borsen (Denmark), La Tribune (France), Il Sole - 24 Ore (Italy), Expansion (Spain), L'agefi (Switzerland), European Ceo (United Kingdom).

"Why the rescue fund is large enough", VOX, www.voxeu.org, February 19th, 2011.

Newspaper Interviews and Discussions (since 2002)

"The German Current Account Surplus is the Result of the Rescue Operations", Crash, March 7th, 2014, pp. 25-30.

Ifo Viewpoints

Ifo Viewpoint No. 139: The Logic of the Target Trap, Nov 30, 2012.

Ifo Viewpoint No. 132: Fed versus ECB: How Target debts can be repaid, Mar 14, 2012.

Ifo Viewpoint No. 130: Buying Out the Store with the Printing Press, Nov 10, 2011.

Ifo Press Releases

"Further Relief Planned on Bailout Loans to Greece", ifo press release, February 11th, 2014.

"Bailing out Greece means haircuts totalling 47 billion euros at the expense of public creditors", ifo press release, November 30th, 2011

Unpublished Discussion Papers

"The Effective Rate of Interest on Target Balances", CESifo Working Paper No. 7878, September 2019 (Download, 214 KB)